Trading is the process of buying and selling financial instruments like stocks, commodities, currencies, and cryptocurrencies to make a profit. Whether you’re an aspiring day trader, swing trader, or long-term investor, understanding the fundamentals is crucial to success. Trading, at its core, is the art of buying something with the intention of selling it for a profit. It happens every day in financial markets, whether in stocks, forex, cryptocurrencies, or commodities. Think of it as a dynamic marketplace where buyers and sellers negotiate prices, influenced by supply, demand, news, and global events.

For beginners, trading can feel overwhelming, but it’s all about understanding the basics. It starts with learning different trading styles—like day trading (buying and selling within a single day), swing trading (holding trades for days or weeks), and long-term investing. Traders use tools like charts, patterns, and financial reports to predict price movements, much like a chess player planning their next move.

However, trading isn’t just about making money—it also comes with risks. Markets can be unpredictable, and emotions like fear and greed can lead to costly mistakes. That’s why successful traders develop a disciplined mindset, use risk management strategies, and continuously learn from their experiences.

At the end of the day, trading is a journey. It’s not about getting rich quickly but rather about making informed decisions, adapting to market changes, and growing your skills over time.

In this guide, we’ll cover the basics of trading, including different types of markets, essential strategies, risk management, and commonly asked questions to help beginners get started with confidence.

Understanding Trading Markets

Before you start trading, it’s essential to understand the markets where trading takes place. Here are some of the most common markets:

1. Stock Market

The stock market involves buying and selling shares of publicly traded companies. It operates through exchanges like the New York Stock Exchange (NYSE) and the Nasdaq. Investors participate in stock trading through individual stocks, exchange-traded funds (ETFs), and mutual funds.

2. Forex Market

The foreign exchange (Forex) market involves trading currency pairs, such as USD/EUR or GBP/JPY. It’s the largest and most liquid market in the world, operating 24 hours a day, five days a week. Forex traders speculate on currency price movements influenced by economic news, geopolitical events, and market sentiment.

3. Commodities Market

Traders can invest in these through futures contracts, ETFs, or direct ownership. Commodities trading is influenced by supply and demand, geopolitical events, and macroeconomic factors.

4. Cryptocurrency Market

Cryptocurrency trading involves digital assets like Bitcoin, Ethereum, and altcoins. These are traded on platforms like Binance, Coinbase, and Kraken. Unlike traditional markets, the crypto market operates 24/7 and is highly volatile.

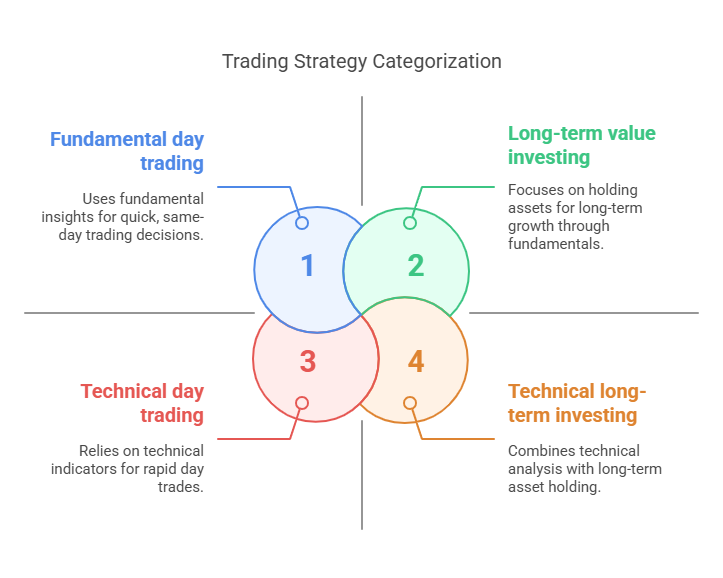

Types of Trading Strategies

There are various trading strategies that traders use depending on their goals and risk tolerance:

1. Day Trading

Day traders buy and sell assets within the same day to capitalize on short-term price movements. They use technical analysis, chart patterns, and indicators to make quick decisions. High volatility and liquidity are essential for day trading success. Day trading requires active monitoring of the markets and can be stressful due to the rapid pace of trades.

2. Swing Trading

Swing traders hold positions for days or weeks, aiming to profit from short- to medium-term price trends. They use a combination of technical and fundamental analysis to identify market opportunities. Swing trading allows for more flexibility compared to day trading and does not require constant monitoring of the markets.

3. Scalping

Scalpers make multiple trades within a day, taking advantage of small price fluctuations. This strategy requires quick decision-making, low spreads, and high trading volume. Scalping can be highly profitable but requires precision, speed, and deep market knowledge. It is best suited for experienced traders who can handle fast-paced trading environments.

4. Position Trading

Position traders hold investments for months or years, focusing on long-term market trends. They rely on fundamental analysis, earnings reports, and economic indicators. Position trading is less stressful than short-term trading methods and is ideal for traders who prefer a long-term perspective. It is commonly used in the stock market and is similar to investing but still involves active management.

5. Algorithmic Trading

Algorithmic traders use computer programs and mathematical models to execute trades automatically based on predefined criteria. This strategy is widely used by institutional traders and hedge funds. Algorithmic trading helps remove emotional bias and can execute trades at high speed with efficiency. However, it requires programming knowledge and sophisticated trading algorithms.

6. Momentum Trading

Momentum traders seek to capitalize on existing market trends by buying assets showing strong upward momentum and selling those with downward momentum. They rely heavily on technical indicators, such as the Relative Strength Index (RSI) and moving averages, to identify potential opportunities. This strategy requires timely execution and works best in highly volatile markets.

7. News-Based Trading

News traders make decisions based on economic announcements, earnings reports, or geopolitical events. They aim to profit from the short-term volatility caused by major news events. This strategy requires staying updated with financial news and reacting quickly to market movements.

8. High-Frequency Trading (HFT)

High-frequency trading is a subset of algorithmic trading where traders use advanced algorithms to execute a large number of orders at very high speeds. It requires significant technological infrastructure and is typically used by hedge funds and institutional traders to capitalize on tiny price differences in milliseconds.

9. Arbitrage Trading

Arbitrage traders take advantage of price differences between two or more markets. For example, a trader may buy an asset in one market where it is underpriced and sell it in another market where it is overpriced. This strategy requires quick execution and access to multiple markets simultaneously.

10. Trend Following

Trend following involves identifying and riding the prevailing trend in a market, whether it’s upward or downward. Traders use moving averages, trendlines, and momentum indicators to confirm the trend direction and enter trades accordingly. This strategy works well in strong, established trends but can lead to losses when markets move sideways.

Key Trading Concepts

Understanding these essential concepts will help you make informed trading decisions:

1. Bid and Ask Price

- Bid Price: The highest price a buyer is willing to pay for an asset.

- Ask Price: The lowest price a seller is willing to accept.

- Spread: The difference between the bid and ask price.

2. Market and Limit Orders

- Market Order: Executes immediately at the best available price.

- Limit Order: Executes only at a specified price or better.

3. Stop-Loss and Take-Profit Orders

- Stop-Loss: Automatically sells an asset to limit losses when the price falls to a specified level.

- Take-Profit: Automatically sells an asset when a price target is reached to secure profits.

4. Leverage and Margin

Leverage allows traders to borrow capital to increase their position size. While it can magnify profits, it also increases risk.

5. Liquidity and Volatility

- Liquidity: How easily an asset can be bought or sold without affecting its price.

- Volatility: The degree of price fluctuations in a market.

Conclusion

By understanding different markets, strategies, and trading concepts, beginners can make informed decisions and improve their chances of success. Trading can be both exciting and rewarding, but it requires patience, discipline, and continuous learning. As a beginner, it’s crucial to understand market fundamentals, develop a strategy that suits your risk tolerance, and practice good risk management. Mistakes are inevitable, but learning from them and staying informed will help you grow as a trader.

Remember, success in trading doesn’t happen overnight. Take the time to build your knowledge, experiment with different strategies, and refine your approach. Whether you’re trading part-time or considering a full-time career, consistency and adaptability will be your greatest assets. Start small, learn as you go, and enjoy the journey toward becoming a skilled trader!

Frequently Asked Questions (FAQs)

1. What is trading?

Trading is the process of buying and selling financial instruments such as stocks, forex, commodities, and cryptocurrencies to generate profit. Traders analyze price movements and market trends to make informed decisions.

2. What are the different types of trading strategies?

There are several trading strategies, including day trading, swing trading, scalping, position trading, algorithmic trading, momentum trading, news-based trading, high-frequency trading (HFT), arbitrage trading, and trend following. Each strategy has its own risk level and time commitment.

3. Is trading risky?

Yes, trading involves risks, including market volatility, leverage risks, and economic uncertainties. Proper risk management, research, and strategy implementation can help mitigate risks.

4. How much money do I need to start trading?

It depend on your marker and broker. Some forex and crypto trading platforms allow you to start with as little as $10, while stock trading may require a few hundred to thousands of dollars.

5. Can I trade without prior experience?

Yes, but it is recommended to learn the basics of trading, market analysis, and risk management before investing real money. Using demo accounts can help you practice without financial risk.

6. What is the difference between trading and investing?

Trading focuses on short-term profits by taking advantage of price fluctuations, while investing aims for long-term wealth accumulation through asset appreciation and dividends.

7. What are bid and ask prices?

- Bid Price: The highest price a buyer is willing to pay for an asset.

- Ask Price: The lowest price a seller is willing to accept.

- Spread: The difference between the bid and ask price.

8. What is leverage in trading?

Leverage is like using a small deposit to control a much larger amount of money in trading. It’s similar to taking a loan from your broker to increase your buying power, allowing you to trade bigger positions than your actual capital.

For example, if you have $1,000 and use 10:1 leverage, you can trade as if you had $10,000. If the trade goes in your favor, your profits are amplified. However, if the market moves against you, losses can also be much larger. This is why leverage is a double-edged sword—it can lead to significant gains but also big losses if not managed carefully.

Traders use leverage to maximize their potential profits, but it’s important to use it responsibly. Setting stop-loss orders and managing risk effectively can help prevent excessive losses when trading with leverage.

9. How do I choose a broker?

When choosing a broker, consider factors such as regulatory compliance, trading fees, platform features, available markets, customer support, and withdrawal policies.

10. What are stop-loss and take-profit orders?

- Stop-Loss Order: Automatically closes a trade to limit losses when the price reaches a predefined level.

- Take-Profit Order: Automatically locks in profits by closing a trade when the price reaches a specific target.

11. What is technical analysis?

Technical analysis involves studying price charts, patterns, and indicators (such as moving averages and RSI) to predict future price movements and make trading decisions.

12. What is fundamental analysis?

Fundamental analysis evaluates financial statements, company performance, economic indicators, and news events to determine the intrinsic value of an asset.

13. Can I trade part-time?

Yes, many traders trade part-time while maintaining other jobs or commitments. Swing trading and position trading are popular among part-time traders.

14. What are the best markets for beginners?

The stock market, forex market, and cryptocurrency market are commonly chosen by beginners. Each market has its advantages and risks, so selecting the one that aligns with your knowledge and risk tolerance is important.

15. How can I improve my trading skills?

- Learn through books, online courses, and webinars.

- Practice with a demo account before trading with real money.

- Keep up with financial news and market trends.

- Develop and refine a trading strategy.

- Manage risk effectively and avoid emotional trading.

16. Can trading be a full-time career?

Yes, some traders make a living from trading, but it requires experience, a solid strategy, risk management, and financial discipline.

17. How do I stay updated with market trends?

Follow financial news platforms, use market analysis tools, join trading communities, and track economic indicators that affect asset prices.

18. What are common mistakes beginners make in trading?

- Overtrading and taking excessive risks.

- Trading without a clear plan or strategy.

- Ignoring risk management techniques.

- Letting emotions drive trading decisions.

- Failing to continuously learn and adapt to market conditions.

19. Do I need a fast internet connection for trading?

A stable and fast internet connection is recommended, especially for day trading and high-frequency trading, where execution speed is crucial.

20. How do taxes work for traders?

Taxation on trading profits varies by country. Some traders may be required to pay capital gains tax or other trading-related taxes. It’s best to consult a tax professional for specific guidelines.

Trading requires patience, discipline, and continuous learning. By understanding the basics and avoiding common pitfalls, beginners can improve their trading success over time.