Stock Markets: A Humanized Look at How They Work and Why They Matter

Introduction

Stock markets—those buzzing, chaotic, and often intimidating financial hubs—are more than just numbers on a screen. Behind every stock ticker, price movement, and headline, there are real people making decisions, feeling emotions, and shaping economies.

But what exactly are stock markets? Why do they matter to everyday people? And how can you, as an individual, navigate them without feeling lost?

This article breaks down stock markets in simple, human terms—no complex jargon, just relatable explanations. By the end, you’ll see stocks not as abstract concepts but as pieces of real businesses, influenced by human behavior, hopes, and fears.

1. What Is a Stock Market? (It’s Just a Big Marketplace)

Imagine a farmers’ market, but instead of fruits and vegetables, people are buying and selling tiny pieces of companies. That’s essentially what a stock market is—a place where investors trade shares (small ownership stakes) in businesses.

Key Players in the Stock Market:

- Investors – People like you and me who buy stocks hoping they’ll grow in value.

- Companies – Businesses that sell shares to raise money (instead of taking loans).

- Brokers – Middlemen who connect buyers and sellers (think of them like eBay for stocks).

- Regulators – Organizations (like the SEC in the U.S.) that keep things fair and prevent fraud.

Stock markets exist worldwide—New York (NYSE, Nasdaq), London (LSE), Tokyo (TSE), and many more. They’re the heartbeat of capitalism, where money flows based on trust, expectations, and sometimes, sheer speculation.

2. Why Do Stock Markets Exist? (Hint: It’s About Growth)

Companies need money to expand, invent new products, or hire more employees. Instead of begging banks for loans (and paying interest), they can go public—and sell shares to the public through an IPO (Initial Public Offering).

How This Helps Everyone:

- Companies get funding without drowning in debt.

- Investors get a chance to grow their wealth by betting on successful businesses.

- The economy benefits because thriving businesses create jobs and innovation.

But here’s the human side: stock prices don’t just reflect cold, hard facts. They’re driven by emotions—greed when prices soar, fear when they crash.

3. How Do Stock Prices Move? (The Human Psychology Behind It)

Stock prices fluctuate constantly due to the interplay of supply and demand. If more people want to buy a stock, its price goes up. If more want to sell (supply), the price drops.

But what makes people buy or sell?

Factors That Move Stock Prices:

- Company Performance – Good profits? Stock rises. Bad results? Stock falls.

- News & Rumors – A CEO scandal, a new product launch, or even a tweet can swing prices.

- Economic Conditions – Inflation, interest rates, and recessions impact investor confidence.

- Human Emotions – Fear of missing out (FOMO) or panic selling during crashes.

Example: If people believe Apple will dominate the next tech wave, they’ll buy Apple stock, pushing its price up—even if nothing has fundamentally changed yet.

4. Bulls vs. Bears: The Two Moods of the Market

You’ve heard of bull markets (rising prices) and bear markets (falling prices). But why these animal names?

- Bull Market – Like a bull charging upward, optimism reigns. People invest more, prices climb.

- Bear Market – Like a bear swiping downward, pessimism takes over. People sell, and prices drop.

Human Behavior in Play:

- In bull markets, greed takes over—people buy overpriced stocks, fearing they’ll miss out.

- In bear markets, fear dominates—people sell even solid companies at low prices.

The best investors stay calm in both, buying when others panic and selling when others are overconfident.

5. How Can Normal People Invest? (Without Losing Their Shirts)

You don’t need to be a Wall Street expert to invest. Here’s how everyday folks can participate:

Simple Ways to Start Investing:

- Stock Trading Apps – Robinhood, E*TRADE, or local brokers let you buy stocks easily.

- Index Funds & ETFs – Instead of picking single stocks, invest in a basket (like the S&P 500).

- Long-Term Mindset – Don’t gamble on short-term swings. Think years, not days.

- Diversify – Don’t put all your money in one stock. Spread risk across industries.

Pro Tip: Most people lose money trying to “time the market.” The smart move? Consistent investing over time (called dollar-cost averaging).

6. Famous Market Crashes (And What They Teach Us)

Stock markets don’t always go up. Sometimes, they crash—hard. Here are two big ones and their lessons:

The 1929 Great Depression

- What Happened? Stocks soared, then collapsed, wiping out fortunes.

- Why? Over-speculation, borrowed money, and panic selling.

- Lesson: Don’t invest money you can’t afford to lose.

The 2008 Financial Crisis

- What Happened? The housing bubble burst, banks collapsed, and stocks plunged.

- Why? Risky loans, excessive debt, and blind trust in the system.

- Lesson: Even “safe” investments can fail. Diversify and stay informed.

Human Takeaway: Crashes hurt, but markets always recover—if you can wait.

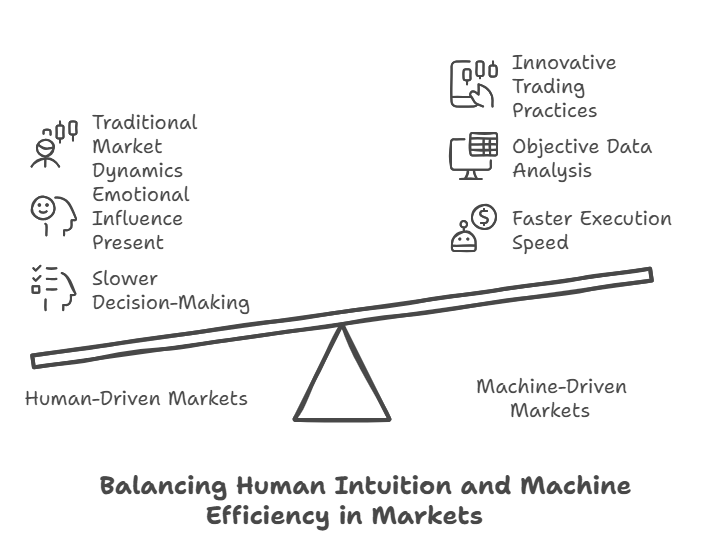

7. The Future of Stock Markets (AI, Crypto, and More)

Stock markets keep evolving. Here’s what’s changing:

- AI & Algorithm Trading – Robots now trade faster than humans (for better or worse).

- Cryptocurrency Markets – Bitcoin and crypto are like a wild new stock market.

- Retail Investors Rising – Apps let normal people band together (like the GameStop saga).

The Big Question: Will markets stay human-driven, or will machines take over completely?

Conclusion: Stock Markets Are Human, After All

At their core, stock markets aren’t just numbers—they’re a reflection of human dreams, fears, and decisions. Whether you’re a casual investor or just curious, understanding the psychology behind markets helps you make smarter choices.

Final Advice:

✅ Invest for the long term.

✅ Don’t let emotions drive your decisions.

✅ Learn from history’s mistakes.

Stock markets will always have ups and downs. But with patience and knowledge, you can ride the waves instead of drowning in them.

Stock Market FAQs

Do stock market questions? We’ve got answers—without the Wall Street jargon. Here are 25 common questions explained like you’re talking to a smart friend.

The Basics

1. What exactly is a stock?

A stock represents a tiny ownership piece of a company. Buy a share of Coca-Cola, and you own a microscopic part of that fizzy drink empire.

2. How is a stock different from a bond?

Stocks = ownership (higher risk/reward). Bonds = loans to companies/governments (more stable, lower returns).

3. What does “going public” mean?

When a company does an IPO (Initial Public Offering), it starts selling shares to the public for the first time.

4. Why do companies sell stocks?

To raise money without taking loans. Instead of owning banks, they share ownership with investors.

Making Money

5. How do people profit from stocks?

Two ways:

- Price appreciation (buy low, sell high)

- Dividends (company profit payouts to shareholders)

6. What’s a dividend?

A company’s way of sharing profits with shareholders—like getting a tiny slice of the pie quarterly.

7. How often do stock prices change?

Constantly during trading hours (9:30 AM – 4 PM EST in U.S. markets). After-hours trading exists too.

8. What makes stock prices move?

Supply/demand, company news, economic trends, and sometimes just investor emotions.

Getting Started

9. How much money do I need to start investing?

Many brokers now let you buy fractional shares—you can start with 5or5or10.

10. What’s the best brokerage for beginners?

Popular easy-to-use options: Fidelity, Charles Schwab, and Robinhood (controversial but simple).

11. Should I use a robo-advisor?

Great for hands-off investors. Betterment and Wealthfront automate investing for you.

12. How many stocks should I own?

Diversification is key. 15-20 across different sectors, or just buy index funds for instant diversity.

Risks & Mistakes

13. Can I lose all my money in stocks?

Yes, if a company goes bankrupt. Spread your investments to minimize this risk.

14. What’s the safest stock investment?

Blue-chip stocks (established companies like Apple, and Microsoft) or broad index funds.

15. What’s the riskiest?

Penny stocks, meme stocks, and anything your cousin “heard about on Reddit.”

16. Why do people say “time in the market beats timing the market”?

Because missing just a few best days can drastically reduce returns. Staying invested wins long-term.

Market Mechanics

17. What’s the difference between NYSE and Nasdaq?

NYSE: Older, hosts established companies. Nasdaq: Tech-heavy, electronic trading.

18. What are bull and bear markets?

Bull = prices rising (optimism). Bear = prices falling (pessimism).

19. What causes a stock market crash?

Usually a combination of overvaluation, economic shocks, and panic selling.

20. How often do crashes happen?

About every 8-10 years historically, but recoveries always follow.

Smart Strategies

21. What’s dollar-cost averaging?

Investing fixed amounts regularly (like $500/month) to smooth out price fluctuations.

22. Are index funds better than picking stocks?

For most people, yes. Over 80% of professional fund managers fail to beat the S&P 500 long-term.

23. When should I sell a stock?

When:

- Your investment thesis changes

- You need the money

- You’ve hit your target price

24. How do taxes work on stock profits?

Capital gains tax applies. Hold >1 year for lower rates (long-term capital gains).

25. Should I check my portfolio daily?

Only if you enjoy stress. Quarterly check-ins are plenty for long-term investors.

Final Tip

The stock market isn’t a casino—it’s a way to own pieces of businesses. The most successful investors think like business owners, not gamblers.Introduction

Stock markets—those buzzing, chaotic, and often intimidating financial hubs—are more than just numbers on a screen. Behind every stock ticker, price movement, and headline, there are real people making decisions, feeling emotions, and shaping economies.

But what exactly are stock markets? Why do they matter to everyday people? And how can you, as an individual, navigate them without feeling lost?

This article breaks down stock markets in simple, human terms—no complex jargon, just relatable explanations. By the end, you’ll see stocks not as abstract concepts but as pieces of real businesses, influenced by human behavior, hopes, and fears.

1. What Is a Stock Market? (It’s Just a Big Marketplace)

Imagine a farmers’ market, but instead of fruits and vegetables, people are buying and selling tiny pieces of companies. That’s essentially what a stock market is—a place where investors trade shares (small ownership stakes) in businesses.

Key Players in the Stock Market:

- Investors – People like you and me who buy stocks hoping they’ll grow in value.

- Companies – Businesses that sell shares to raise money (instead of taking loans).

- Brokers – Middlemen who connect buyers and sellers (think of them like eBay for stocks).

- Regulators – Organizations (like the SEC in the U.S.) that keep things fair and prevent fraud.

Stock markets exist worldwide—New York (NYSE, Nasdaq), London (LSE), Tokyo (TSE), and many more. They’re the heartbeat of capitalism, where money flows based on trust, expectations, and sometimes, sheer speculation.

2. Why Do Stock Markets Exist? (Hint: It’s About Growth)

Companies need money to expand, invent new products, or hire more employees. Instead of begging banks for loans (and paying interest), they can go public—and sell shares to the public through an IPO (Initial Public Offering).

How This Helps Everyone:

- Companies get funding without drowning in debt.

- Investors get a chance to grow their wealth by betting on successful businesses.

- The economy benefits because thriving businesses create jobs and innovation.

But here’s the human side: stock prices don’t just reflect cold, hard facts. They’re driven by emotions—greed when prices soar, fear when they crash.

3. How Do Stock Prices Move? (The Human Psychology Behind It)

Stock prices fluctuate constantly due to the interplay of supply and demand. If more people want to buy a stock, its price goes up. If more want to sell (supply), the price drops.

But what makes people buy or sell?

Factors That Move Stock Prices:

- Company Performance – Good profits? Stock rises. Bad results? Stock falls.

- News & Rumors – A CEO scandal, a new product launch, or even a tweet can swing prices.

- Economic Conditions – Inflation, interest rates, and recessions impact investor confidence.

- Human Emotions – Fear of missing out (FOMO) or panic selling during crashes.

Example: If people believe Apple will dominate the next tech wave, they’ll buy Apple stock, pushing its price up—even if nothing has fundamentally changed yet.

4. Bulls vs. Bears: The Two Moods of the Market

You’ve heard of bull markets (rising prices) and bear markets (falling prices). But why these animal names?

- Bull Market – Like a bull charging upward, optimism reigns. People invest more, prices climb.

- Bear Market – Like a bear swiping downward, pessimism takes over. People sell, and prices drop.

Human Behavior in Play:

- In bull markets, greed takes over—people buy overpriced stocks, fearing they’ll miss out.

- In bear markets, fear dominates—people sell even solid companies at low prices.

The best investors stay calm in both, buying when others panic and selling when others are overconfident.

5. How Can Normal People Invest? (Without Losing Their Shirts)

You don’t need to be a Wall Street expert to invest. Here’s how everyday folks can participate:

Simple Ways to Start Investing:

- Stock Trading Apps – Robinhood, E*TRADE, or local brokers let you buy stocks easily.

- Index Funds & ETFs – Instead of picking single stocks, invest in a basket (like the S&P 500).

- Long-Term Mindset – Don’t gamble on short-term swings. Think years, not days.

- Diversify – Don’t put all your money in one stock. Spread risk across industries.

Pro Tip: Most people lose money trying to “time the market.” The smart move? Consistent investing over time (called dollar-cost averaging).

6. Famous Market Crashes (And What They Teach Us)

Stock markets don’t always go up. Sometimes, they crash—hard. Here are two big ones and their lessons:

The 1929 Great Depression

- What Happened? Stocks soared, then collapsed, wiping out fortunes.

- Why? Over-speculation, borrowed money, and panic selling.

- Lesson: Don’t invest money you can’t afford to lose.

The 2008 Financial Crisis

- What Happened? The housing bubble burst, banks collapsed, and stocks plunged.

- Why? Risky loans, excessive debt, and blind trust in the system.

- Lesson: Even “safe” investments can fail. Diversify and stay informed.

Human Takeaway: Crashes hurt, but markets always recover—if you can wait.

7. The Future of Stock Markets (AI, Crypto, and More)

Stock markets keep evolving. Here’s what’s changing:

- AI & Algorithm Trading – Robots now trade faster than humans (for better or worse).

- Cryptocurrency Markets – Bitcoin and crypto are like a wild new stock market.

- Retail Investors Rising – Apps let normal people band together (like the GameStop saga).

The Big Question: Will markets stay human-driven, or will machines take over completely?

Conclusion: Stock Markets Are Human, After All

At their core, stock markets aren’t just numbers—they’re a reflection of human dreams, fears, and decisions. Whether you’re a casual investor or just curious, understanding the psychology behind markets helps you make smarter choices.

Final Advice:

✅ Invest for the long term.

✅ Don’t let emotions drive your decisions.

✅ Learn from history’s mistakes.

Stock markets will always have ups and downs. But with patience and knowledge, you can ride the waves instead of drowning in them.

Stock Market FAQs: 25 Questions Answered in Plain English

Do stock market questions? We’ve got answers—without the Wall Street jargon. Here are 25 common questions explained like you’re talking to a smart friend.

The Basics

1. What exactly is a stock?

A stock represents a tiny ownership piece of a company. Buy a share of Coca-Cola, and you own a microscopic part of that fizzy drink empire.

2. How is a stock different from a bond?

Stocks = ownership (higher risk/reward). Bonds = loans to companies/governments (more stable, lower returns).

3. What does “going public” mean?

When a company does an IPO (Initial Public Offering), it starts selling shares to the public for the first time.

4. Why do companies sell stocks?

To raise money without taking loans. Instead of owning banks, they share ownership with investors.

Making Money

5. How do people profit from stocks?

Two ways:

- Price appreciation (buy low, sell high)

- Dividends (company profit payouts to shareholders)

6. What’s a dividend?

A company’s way of sharing profits with shareholders—like getting a tiny slice of the pie quarterly.

7. How often do stock prices change?

Constantly during trading hours (9:30 AM – 4 PM EST in U.S. markets). After-hours trading exists too.

8. What makes stock prices move?

Supply/demand, company news, economic trends, and sometimes just investor emotions.

Getting Started

9. How much money do I need to start investing?

Many brokers now let you buy fractional shares—you can start with 5or5or10.

10. What’s the best brokerage for beginners?

Popular easy-to-use options: Fidelity, Charles Schwab, and Robinhood (controversial but simple).

11. Should I use a robo-advisor?

Great for hands-off investors. Betterment and Wealthfront automate investing for you.

12. How many stocks should I own?

Diversification is key. 15-20 across different sectors, or just buy index funds for instant diversity.

Risks & Mistakes

13. Can I lose all my money in stocks?

Yes, if a company goes bankrupt. Spread your investments to minimize this risk.

14. What’s the safest stock investment?

Blue-chip stocks (established companies like Apple, and Microsoft) or broad index funds.

15. What’s the riskiest?

Penny stocks, meme stocks, and anything your cousin “heard about on Reddit.”

16. Why do people say “time in the market beats timing the market”?

Because missing just a few best days can drastically reduce returns. Staying invested wins long-term.

Market Mechanics

17. What’s the difference between NYSE and Nasdaq?

NYSE: Older, hosts established companies. Nasdaq: Tech-heavy, electronic trading.

18. What are bull and bear markets?

Bull = prices rising (optimism). Bear = prices falling (pessimism).

19. What causes a stock market crash?

Usually a combination of overvaluation, economic shocks, and panic selling.

20. How often do crashes happen?

About every 8-10 years historically, but recoveries always follow.

Smart Strategies

21. What’s dollar-cost averaging?

Investing fixed amounts regularly (like $500/month) to smooth out price fluctuations.

22. Are index funds better than picking stocks?

For most people, yes. Over 80% of professional fund managers fail to beat the S&P 500 long-term.

23. When should I sell a stock?

When:

- Your investment thesis changes

- You need the money

- You’ve hit your target price

24. How do taxes work on stock profits?

Capital gains tax applies. Hold >1 year for lower rates (long-term capital gains).

25. Should I check my portfolio daily?

Only if you enjoy stress. Quarterly check-ins are plenty for long-term investors.

Final Tip

The stock market isn’t a casino—it’s a way to own pieces of businesses. The most successful investors think like business owners, not gamblers.