Introduction: The Fragility of the American Dream

We like to believe in control—that if we work hard, save wisely, and live responsibly, we’ll be okay. But life doesn’t always follow the script.

One slip on an icy sidewalk.

One diagnosis at a routine checkup.

One moment of distracted driving.

Suddenly, the life you’ve built—the career, the mortgage, the family vacations—hangs in the balance. Not because you made a mistake, but because life happened.

This is the uncomfortable truth: Your greatest financial risk isn’t the stock market crashing or your house losing value—it’s your ability to earn an income disappearing overnight.

Disability insurance isn’t just another policy. It’s the difference between stability and catastrophe.

1. The Illusion of Invincibility: Why We Underestimate Disability

“It Won’t Happen to Me” (Until It Does)

Humans are terrible at assessing risk. We buy lottery tickets against impossible odds but ignore the 1 in 4 chance we’ll face a disability before retirement.

We see disabilities as dramatic events—paralysis, blindness, traumatic brain injuries. But most claims stem from:

- Chronic pain (a herniated disc from lifting a child)

- Mental health struggles (depression that makes work impossible)

- Autoimmune diseases (MS, Crohn’s, rheumatoid arthritis)

- Cancer treatments (chemotherapy fatigue lasting months)

These aren’t rare tragedies. They’re ordinary medical issues with extraordinary financial consequences.

The Financial Domino Effect

Without disability insurance:

- Savings evaporate (The average American can’t cover a $1,000 emergency.)

- Debt balloons (Credit cards, medical bills, payday loans.)

- Assets liquidate (Retirement accounts drained, home equity borrowed against.)

- Relationships fracture (Money stress is a leading cause of divorce.)

Disability insurance stops the dominoes from falling.

2. The Broken Safety Nets: Why Government Help Isn’t Enough

Social Security Disability Insurance (SSDI): A System in Crisis

- Denial rate: 70% of initial claims are rejected.

- Wait time: 2+ years for appeals (while bills pile up).

- Average benefit: $1,300/month—below the poverty line for a single person.

Workers’ Compensation: Only for On-the-Job Injuries

- Doesn’t cover illnesses (e.g., heart attack, cancer).

- Many claims are disputed by employers.

State Short-Term Disability: A Patchwork Solution

Only five states (CA, HI, NJ, NY, RI) mandate short-term disability benefits. Elsewhere? You’re on your own.

Bottom line: Relying on government programs is like bringing a Band-Aid to a hemorrhage.

3. The Two Faces of Disability Insurance: Short-Term vs. Long-Term

Short-Term Disability (STD): The Immediate Cushion

- What it covers: Recovery from surgeries, pregnancies, temporary injuries.

- Reality check: Most people exhaust STD benefits before they’re fully healed.

Example: A teacher with a complicated pregnancy is bedridden for 4 months. STD replaces 70% of her salary—just enough to avoid defaulting on her student loans.

Long-Term Disability (LTD): The Life Preserver

- What it covers: Debilitating conditions (MS, severe depression, back injuries).

- Critical feature: “Own-occupation” vs. “Any-occupation” definitions.

Key distinction:

- “Own-occupation”: Pays if you can’t do your specific job (e.g., a surgeon with hand tremors).

- “Any-occupation”: Only pays if you can’t work any job (e.g., forcing a surgeon to flip burgers).

Pro tip: Always fight for “own-occupation” coverage. The difference is life-changing.

4. The Hidden Gaps in Employer Coverage

The Fine Print That Screws You

Many employer-sponsored plans:

- Cap benefits at 50-60% of salary (before taxes).

- Use “any-occupation” definitions after 2 years.

- Are taxable if the employer pays premiums (unlike individually owned policies).

Example: A marketing exec earning 120,000getsLTDthroughwork.Aftertaxes, her benefits∗∗120,000getsLTDthroughwork.Aftertaxes,herbenefitis∗∗3,000/month**—not enough to maintain her lifestyle.

Why You Need a Personal Policy

- Customizable (Add riders for cost-of-living adjustments.)

- Non-cancelable (Insurer can’t drop you if you get sick.)

5. The Emotional Cost of Disability (Beyond the Dollars)

The Identity Crisis

For many, work isn’t just a paycheck—it’s purpose. Losing that can lead to:

- Depression (Feeling like a “burden.”)

- Isolation (Friends drift away when you can’t socialize.)

- Marital strain (70% of couples argue more about money after a disability.)

Disability insurance isn’t just about money. It’s about dignity.

6. How to Get Covered (When You Think You Can’t)

Pre-Existing Conditions: Not Always a Deal breaker

- Group plans (through work) often cover them.

- Exclusions (Some insurers will cover you but exclude your condition).

- Specialty insurers (Companies like Lloyd’s of London take on high-risk cases.)

The Self-Employed Dilemma

Freelancers and small-business owners are most vulnerable—and least likely to have coverage. Solutions:

- Disability overhead insurance (Pays business expenses if you’re disabled.)

- Business interruption riders (For sole proprietors.)

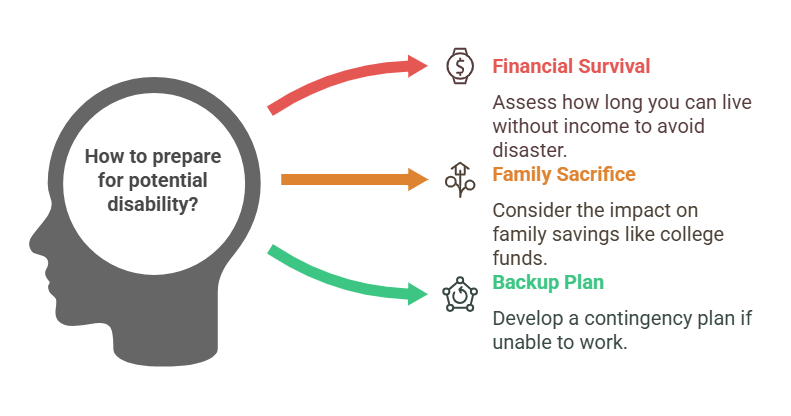

7. The Hard Questions You Need to Ask Yourself

- How long could I survive without income?

(Most Americans are one missed paycheck from disaster.) - Would my family have to sacrifice their future?

(College funds? Retirement? Your disability shouldn’t bankrupt them.) - What’s my Plan B if I can’t work?

(Hope isn’t a strategy.)

Conclusion: The Policy You Buy Today Could Save Your Life Tomorrow

Disability insurance isn’t morbid—it’s empowering. It’s saying:

- “I matter.”

- “My family’s security isn’t negotiable.”

- “I won’t let bad luck destroy everything I’ve built.”

Action steps:

- Audit your current coverage (Employer? Private policy?)

- Calculate your needs (Aim for 60-70% of after-tax income.)

- Talk to an independent broker (They shop multiple insurers for you.)

What is the best time to buy disability insurance? Before you need it. The second-best time? Today.

“But I’m young/healthy/covered through work!”

—Said every person who later filed a disability claim.

Don’t wait for a wake-up call. Protect your income. Protect your life.

Disability Insurance FAQs: Your Top Questions Answered

1. What exactly does disability insurance cover?

Disability insurance replaces a portion of your income (typically 50-70%) if you become unable to work due to:

- Illness (cancer, heart disease, severe depression)

- Injury (car accident, back injury, repetitive strain)

- Chronic conditions (MS, arthritis, diabetes complications)

It does not cover unemployment, voluntary leave, or pre-existing conditions (unless specified in your policy).

2. How is disability insurance different from health insurance?

- Health insurance pays for medical bills (doctor visits, surgeries, prescriptions).

- Disability insurance replaces lost income so you can pay rent, groceries, and other living expenses while you recover.

Think of it this way:

- Health insurance keeps you alive.

- Disability insurance keeps you from going broke while you heal.

3. How long do disability benefits last?

- Short-term disability (STD): 3 months to 1 year.

- Long-term disability (LTD): 2 years, 5 years, or until retirement age (depends on the policy).

Key factor: The more severe the disability, the longer benefits last.

4. How soon do benefits start after I file a claim?

- Short-term disability: As soon as 1-14 days (varies by policy).

- Long-term disability: Typically, 90-180 days (you’ll rely on savings or STD first).

This waiting period is called the elimination period—like a deductible, but in time, not dollars.

5. Will disability insurance cover mental health conditions?

Yes, but with caveats:

- Many policies limit payouts for mental health claims (e.g., 24 months max).

- Severe cases (schizophrenia, bipolar disorder) may qualify for longer benefits.

Tip: Look for a policy with equal coverage for physical and mental disabilities.

6. How much does disability insurance cost?

- Short-term disability: ~1-3% of your annual salary (e.g., 30/monthfora30/monthfora50k income).

- Long-term disability: ~2-6% (e.g., 100/monthfora100/monthfora100k income).

Factors affecting cost:

- Age (cheaper when you’re young & healthy)

- Occupation (riskier jobs = higher premiums)

- Benefit amount & length

7. Can I get disability insurance if I’m self-employed?

Yes! Options include:

- Individual policies (more expensive but customizable).

- Overhead expense coverage (pays business bills if you’re disabled).

- Professional association group plans (often cheaper).

Freelancers, take note: No employer = no safety net. This is non-negotiable coverage.

8. What if I change jobs? Does my coverage disappear?

- Employer-provided coverage: Usually ends when you leave the job.

- Private policy: Stays with you no matter where you work.

Pro move: Combine both for maximum protection.

9. Will disability insurance pay if I can work part-time?

Some policies offer partial disability benefits, paying a reduced amount if you:

- Return to work with fewer hours.

- Earn less due to your disability.

Example: A graphic designer with carpal tunnel shifts to 20 hers/week—her policy covers half her lost income.

10. What’s the #1 mistake people make with disability insurance?

Waiting until it’s too late.

- Denial stats: 37% of disability claims are from people under 50.

- Approval delays: Getting a policy takes 3-6 months (if you develop a health issue).

Don’t gamble with your income. Get covered while you’re still eligible.

11. “If I become disabled, won’t my family just take care of me?”

The heartbreaking reality: 73% of caregivers report significant financial strain, and 1 in 4 dip into retirement savings. Disability insurance preserves relationships by:

- Preventing resentment from becoming your family’s financial burden

- Allowing loved ones to focus on care instead of bills

- Maintaining your role as provider rather than dependent

12. “Can’t I just rely on my spouse’s income?”

Modern relationships aren’t built for single-income survival:

- The average two-income family would need to cut expenses by 42% to survive on one salary

- 58% of Americans live paycheck to paycheck regardless of income level

- Dual-career couples often have dual mortgages/student loans that one income can’t sustain

13. “What if my disability comes and goes – will I keep losing coverage?”

The cruel cycle of episodic disabilities (like MS or lupus):

- Most policies have “recurrent disability” clauses that protect you if the same condition flares up

- Without this protection, you could exhaust benefits just as you need them most

- Look for policies that treat related conditions as one continuous claim

14. “How does disability insurance account for career growth?”

The silent thief: lost future earnings. A 30-year-old disabled today loses:

- 35 years of compounding salary increases

- 401(k) matches and retirement growth

- Career advancement opportunities

Solution: Policies with future increase options or cost-of-living adjustments

15. “What happens if I recover but can’t return to my old career?”

The vocational purgatory no one discusses:

- A teacher with vocal cord damage may never teach again

- A chef with nerve damage may lose their sense of taste

- An accountant with TBI may struggle with concentration

These questions reveal disability insurance isn’t just about money – it’s about protecting your life’s trajectory, relationships, and sense of self when your body betrays you. The right policy doesn’t just replace income; it preserves possibilities.

Final Thought

Disability insurance isn’t about fear—it’s about respecting your future self. The next time you hear someone say, “I’ll worry about it later,” ask them:

“What’s your plan if ‘later’ never comes?”