Debt isn’t just about numbers—it’s about stress, sleepless nights, and feeling trapped in a cycle you can’t escape. If you’re drowning in multiple payments, high interest rates, and the constant anxiety of “What if I miss one?”, a debt consolidation loan could be more than just a financial tool—it could be a lifeline.

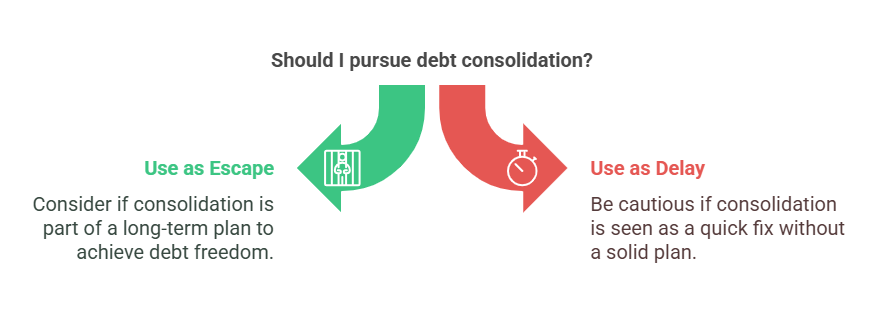

But here’s the truth: Not all debt consolidation is created equal. Some people use it to break free, while others end up worse off. This isn’t just about “combining debts”—it’s about strategy, discipline, and making the right choices for your future.

Let’s go beyond the basics and explore:

- The psychology of debt consolidation—why it works (and when it backfires).

- The fine print nobody talks about—hidden fees, credit impacts, and long-term costs.

- Real-life case studies—people who succeeded (and those who failed).

- Alternatives you haven’t considered—because sometimes, consolidation isn’t the answer.

This isn’t just financial advice—it’s a roadmap to true financial freedom.

The Psychology of Debt Consolidation: Why It Feels Like a Fresh Start

The Mental Burden of Multiple Debts

Studies show that juggling multiple debts increases stress and reduces financial clarity. When you’re paying five different creditors, your brain treats each one as a separate “threat,” making debt feel bigger than it actually is.

Consolidation simplifies this. One payment. One interest rate. One deadline. Your brain relaxes.

But here’s the catch: Relief can lead to complacency. Some people consolidate, feel “free,” and then start spending again. That’s how they end up with a new loan AND new credit card debt.

The “Clean Slate” Effect (And Its Dangers)

- Good: Consolidation gives you a structured plan—like hitting “reset” on your finances.

- Bad: Some people treat it like a get-out-of-jail-free card and repeat the same mistakes.

Key Question: Are you consolidating to escape debt… or just to buy yourself more time?

The Fine Print Nobody Warns You About

1. The “Lower Interest Rate” Trap

Lenders love to advertise “Lower your payments!” But what if they’re stretching your debt over 10 years instead of 3?

Example:

- Current Debt: 20,000at1820,000at187,200 in interest.

- Consolidated Loan: 20,000at1220,000at129,600 in interest.

You saved on monthly payments… but paid more overall.

2. Origination Fees & Hidden Costs

Some lenders charge 1–6% upfront just to give you the loan. That means:

- 10,000loan+510,000loan+5500 gone before you even start.

Always ask: “What’s the APR, including fees?”

3. The Credit Score Rollercoaster

- Short-Term Dip: Applying for a new loan triggers a hard inquiry (small credit hit).

- Long-Term Boost: Paying off credit cards lowers utilization, which helps your score.

- Danger Zone: If you close old accounts, your credit history shortens, which can hurt.

Pro Move: Keep old accounts open but unused (cut up the cards if needed).

Real-Life Stories: Who Wins & Who Loses with Debt Consolidation

Success Story: Maria’s Escape from the Credit Card Cycle

- Debt: $15,000 across 3 cards (24% APR).

- Consolidated: Got a personal loan at 10% APR.

- Result: Paid off in 4 years, saved $6,000 in interest, and never touched credit cards again.

Why It Worked: She cut up her cards and stuck to a budget.

Failure Story: Jake’s Double-Debt Disaster

- Debt: $12,000 in credit cards.

- Consolidated: Took a loan, paid off cards… then racked up $10,000 more in new charges.

- Now: Owes **22,000∗∗insteadof22,000∗∗insteadof12,000.

What Went Wrong: He saw consolidation as a “quick fix,” not a behavior change.

When Debt Consolidation Is the WRONG Move

1. If You’re Already in Deep Financial Trouble

- Behind on rent?

- Using credit cards for groceries?

- No emergency savings?

Consolidation won’t fix income problems. You might need credit counseling or even bankruptcy advice instead.

2. If Your Credit Score Is Below 600

- You’ll likely get high-interest offers (15%+ APR).

- Might be better off with a debt management plan (DMP) through a nonprofit.

3. If You Haven’t Fixed the Root Problem

- Are you consolidating because of a one-time emergency (medical bill)? → Good.

- Or because you overspend every month? → You’ll just relapse.

Alternatives to Debt Consolidation Loans

1. Debt Snowball vs. Debt Avalanche

- Snowball: Pay off the smallest debts first (quick wins = motivation).

- Avalanche: Pay off highest-interest debts first (saves more money).

Best for: People who don’t qualify for a good consolidation rate.

2. Credit Counseling & DMPs

- Nonprofit agencies negotiate lower rates for you.

- You pay them one monthly payment.

- Cost: Small setup fee + monthly fee (~$50 total).

Best for: Those with fair credit who need structure.

3. Balance Transfer Cards (0% APR)

- Move debt to a card with 0% interest for 12–18 months.

- Catch: If you don’t pay it off in time, interest jumps to 25%+.

Best for: Disciplined people with good credit.

The Ultimate Checklist: Is Debt Consolidation Right for You?

✅ You can get a lower APR than your current debts.

✅ You’re committed to not taking on new debt.

✅ You have a stable income to make payments.

✅ You’ve addressed the root cause of your debt (overspending, emergencies, etc.).

If you checked all four → Consolidation could work.

If not → Try alternatives first.

Final Thought: Debt Consolidation Isn’t the Goal—Freedom Is

A loan can rearrange your debt, but only you can eliminate it. The real solution isn’t just math—it’s about behavior change, budgeting, and having a clear plan.

Ask yourself:

- “Am I using this to escape debt… or just delay it?”

- “What’s my plan to stay debt-free after consolidation?”

If you’re ready to break the cycle for good, consolidation can help. But if you’re looking for a quick fix, tread carefully.

The Ultimate Debt Consolidation Loan FAQ Guide

1. What Exactly Is a Debt Consolidation Loan?

A debt consolidation loan is a financial tool that allows you to combine multiple debts into a single new loan. This typically includes:

- Credit card balances

- Personal loans

- Medical bills

- Store credit cards

- Payday loans (in some cases)

How it works: You take out one larger loan to pay off all your smaller debts, leaving you with just one monthly payment at (ideally) a lower interest rate.

Key benefit: Simplifies repayment by turning multiple due dates and varying interest rates into one predictable payment.

2. How Does Debt Consolidation Affect My Credit Score?

Your credit score may be impacted in many ways:

Initial impact (short-term):

- Hard inquiry when applying (typically 5-10 point drop)

- A new credit account appears on your report

Long-term effects:

- Positive: Lower credit utilization ratio (if paying off credit cards)

- Positive: On-time payments improve payment history

- Potential negative: Closing old accounts may reduce credit history length

Pro tip: The initial dip usually recovers within 3-6 months if you make payments on time.

3. What’s the Difference Between Debt Consolidation and Debt Settlement?

These are fundamentally different approaches:

| Feature | Debt Consolidation | Debt Settlement |

| Repayment | Full amount owed | Less than owed |

| Credit Impact | Minimal long-term damage | Severe damage |

| Creditor Relations | Maintains good standing | Damaged relationship |

| Tax Consequences | None | Forgiven debt may be taxable |

| Cost | Interest charges | 15-25% of debt in fees |

Best for consolidation: Those who can afford to repay full amounts but need better terms

Best for settlement: Those facing true financial hardship who can’t repay in full

4. Can I Include Student Loans in Debt Consolidation?

The answer depends on loan type:

Federal student loans:

- Cannot be combined with other consumer debt

- Must use federal consolidation program

- Maintains federal loan benefits

Private student loans:

- May be eligible with some lenders

- Losing federal protections if consolidated privately

Important: Refinancing federal loans privately makes them ineligible for income-driven repayment or forgiveness programs.

5. What Credit Score Do I Need to Qualify?

Here’s the breakdown by credit tier:

Excellent (720+):

- Best rates (6-12% APR)

- Highest approval odds

- May qualify for largest loan amounts

Good (670-719):

- Competitive rates (10-18% APR)

- Strong approval chances

- May need to shop around

Fair (580-669):

- Higher rates (15-36% APR)

- May need co-signer

- Some lenders specialize in fair credit

Poor (<580):

- Few traditional options

- May need a secured loan

- Consider credit repair first

6. How Much Money Can I Save With Consolidation?

Potential savings depend on:

- Current interest rates

- New loan’s APR

- Repayment term length

Example calculation:

- $20,000 total debt

- Current average APR: 22%

- New consolidation loan: 12% APR

- 5-year repayment

Savings: Approximately $8,000 in interest over the loan term

Use our rule of thumb: Every 1% reduction in APR saves about 100annuallyper100annuallyper10,000 borrowed.

7. What Fees Should I Watch Out For?

Common fees include:

Origination fees: 1-6% of the loan amount (often deducted from loan proceeds)

Prepayment penalties: Some lenders charge for early payoff

Late payment fees: Typically 15−15−35

Check processing fees: If paying by paper check

How to avoid fees:

- Compare multiple lenders

- Read the fine print

- Ask about fee waivers

- Set up autopay (often gets you a rate discount too)

8. How Long Does the Application Process Take?

The timeline varies by lender type:

Online lenders:

- Application: 10-15 minutes

- Approval: Instant to 24 hours

- Funding: 1-3 business days

Banks/Credit Unions:

- Application: 30+ minutes

- Approval: 1-7 days

- Funding: 3-10 business days

Factors affecting timing:

- Completeness of your application

- Verification process

- Weekends/holidays

- Loan amount (larger loans take longer)

9. Can I Consolidate Payday Loans?

Yes, but with important caveats:

Challenges:

- Extremely high interest rates (300-400% APR)

- Some lenders exclude payday loans

- May require special programs

Better alternatives:

- Credit counseling agency assistance

- Payday alternative loans (PALs) from credit unions

- State-specific relief programs

Warning: Rolling over payday loans creates a dangerous cycle. Prioritize paying these off first.

10. What If I Get Denied? Next Steps

Don’t panic. Try these options:

- Ask why: Lenders must provide adverse action notices

- Improve your application:

- Pay down some debt first

- Add a co-signer

- Correct credit report errors

- Alternative lenders:

- Credit unions

- Online specialty lenders

- Peer-to-peer platforms

- Non-loan options:

- Debt management plan

- Balance transfer card

- Credit counseling

11. Will My Credit Cards Be Paid Off Immediately?

The process works like this:

- Lender approves your loan

- Funds are disbursed (often directly to creditors)

- Credit card balances show as paid

- You begin making loan payments

Important: Creditors may take 3-7 business days to update balances. Don’t use the cards during this period.

12. Can I Include Tax Debt or Legal Judgments?

Generally no. These typically can’t be consolidated because:

- Tax debt has special repayment programs

- Court-ordered payments can’t be modified

- Child support/alimony are priority debts

Alternatives for these debts:

- IRS installment agreements

- Offer in Compromise

- Court payment plans

13. Should I Close My Credit Cards After Consolidating?

No, and here’s why:

Credit score impacts:

- Reduces total available credit → higher utilization

- May shorten credit history length

- Fewer active accounts can hurt mix of credit

Better approach:

- Keep cards open

- Remove them from your wallet

- Use minimally (one small charge monthly)

- Pay statement balance in full

14. How Is This Different from Bankruptcy?

Critical differences:

| Factor | Consolidation | Bankruptcy |

| Debt Status | Repaid in full | Discharged or restructured |

| Credit Impact | Minor/moderate | Severe (Ch.7: 10 years) |

| Cost | Interest charges | Legal fees ($1,500+) |

| Public Record | No | Yes |

| Future Credit | Rebuild quickly | Difficult for years |

Bankruptcy should be last resort: Exhaust all other options first.

15. Which Lenders Offer the Best Terms?

Top options by category:

Best for excellent credit:

- SoFi (lowest rates)

- LightStream

- Discover

Best for good credit:

- Upstart

- Marcus

- LendingClub

Best for fair credit:

- Avant

- OneMain Financial

- Upgrade

Credit union options:

- Navy Federal

- PenFed

- Local CUs often have special programs

16. Can I Negotiate Rates Myself?

Yes! Try these strategies:

With current creditors:

- Call and ask for lower APR

- Request hardship programs

- Inquire about balance transfer offers

With new lenders:

- Leverage competing offers

- Highlight strong payment history

- Consider adding collateral

Success rate: About 30-40% of negotiation attempts succeed, saving 2-5% on average.

17. What’s the Most Common Mistake?

The relapse cycle:

- Consolidate credit card debt

- Feel “rich” with $0 balances

- Start charging again

- End up with loan payments AND new credit card debt

How to avoid:

- Cut up or freeze cards

- Delete saved payment methods

- Use cash/debit only

- Create a realistic budget

18. How Do I Spot Scams?

Red flags:

🚩 Upfront fees before providing service

🚩 Guaranteed approval claims

🚩 Pressure to act immediately

🚩 No physical address

🚩 Requests for unusual payment methods

Safe alternatives:

- Nonprofit credit counseling (NFCC.org)

- FDIC-insured lenders

- Your local credit union

19. Are Home Equity Loans Better?

Pros and cons:

Advantages:

- Lower interest rates (often 4-8%)

- Potential tax deduction (consult CPA)

- Longer repayment terms

Risks:

- Your home is collateral

- Possible foreclosure if you default

- Closing costs (2-5% of loan amount)

Best for: Homeowners with equity who need large amounts and have stable income.

20. What’s the Golden Rule for Success?

Behavior change beats financial tricks:

- Track all spending for 30 days

- Create a realistic budget

- Build a $1,000 emergency fund

- Automate savings

- Address emotional spending triggers

Remember: Consolidation is a tool, not a solution. Lasting debt freedom requires changing money habits.

Final Checklist Before Applying

✅ Compare at least 3-5 lenders

✅ Calculate total costs (interest + fees)

✅ Read all fine print

✅ Have a relapse prevention plan

✅ Consider consulting a credit counselor

Need personalized advice? Many nonprofit credit counseling agencies offer free consultations.