Starting or expanding a business often requires capital, and not every entrepreneur has enough savings to fund their vision. That’s where business loans come in. Whether you need money for inventory, equipment, hiring staff, or covering day-to-day expenses, a business loan can provide the financial boost you need.

But with so many loan options available, how do you choose the right one? What are the requirements? And how can you improve your chances of approval?

In this guide, we’ll break down everything you need to know about business loans in simple, human terms—no confusing jargon, just clear and practical advice to help you make the best financial decision for your business.

Table of Contents

- What Is a Business Loan?

- Types of Business Loans

- Term Loans

- SBA Loans

- Business Lines of Credit

- Equipment Financing

- Invoice Financing

- Merchant Cash Advances

- How Do Business Loans Work?

- Why Do Businesses Need Loans?

- Eligibility Criteria for Business Loans

- How to Apply for a Business Loan

- Tips to Improve Loan Approval Chances

- Pros and Cons of Business Loans

- Alternatives to Business Loans

- Final Thoughts: Is a Business Loan Right for You?

1. What Is a Business Loan?

A business loan is money borrowed from a bank, credit union, or online lender to fund business-related expenses. Unlike personal loans, business loans are specifically designed to help companies grow, manage cash flow, or cover unexpected costs.

The borrower agrees to repay the loan amount (principal) plus interest over a set period. Some loans may also require collateral (assets like property or equipment that the lender can seize if you default).

2. Types of Business Loans

Not all business loans are the same. The best option for you depends on your needs, credit score, and how quickly you need funds. Here are the most common types:

A. Term Loans

- What it is: A lump sum of money repaid over a fixed term (1–10 years).

- Best for: Large, one-time expenses like expansion or major purchases.

- Interest rates: Vary (secured loans have lower rates than unsecured ones).

B. SBA Loans (Small Business Administration Loans)

- What it is: Government-backed loans with favorable terms.

- Best for: Small businesses that need affordable, long-term financing.

- Interest rates: Typically, lower than traditional bank loans.

C. Business Lines of Credit

- What it is: A flexible credit limit you can draw from as needed (like a credit card).

- Best for: Managing cash flow gaps or unexpected expenses.

- Interest rates: Only pay interest on the amount used.

D. Equipment Financing

- What it is: A loan specifically to purchase business equipment.

- Best for: Companies needing machinery, vehicles, or technology.

- Interest rates: The equipment itself serves as collateral.

E. Invoice Financing

- What it is: Borrowing against unpaid customer invoices.

- Best for: Businesses with long payment cycles (e.g., B2B companies).

- Interest rates: Fees depend on how long invoices are outstanding.

F. Merchant Cash Advances (MCAs)

- What it is: An advance based on future credit card sales.

- Best for: Businesses with high credit card transactions (e.g., retail, restaurants).

- Interest rates: Can be expensive (factor rates instead of APR).

3. How Do Business Loans Work?

Here’s a simple breakdown of the process:

- Apply: Fill out an application with a lender (bank, online, or credit union).

- Submit Documents: Provide financial statements, tax returns, and business plans.

- Underwriting: The lender reviews your credit, revenue, and risk level.

- Approval & Funding: If approved, you receive funds (timing varies by lender).

- Repayment: Pay back the loan in installments (monthly, weekly, or daily).

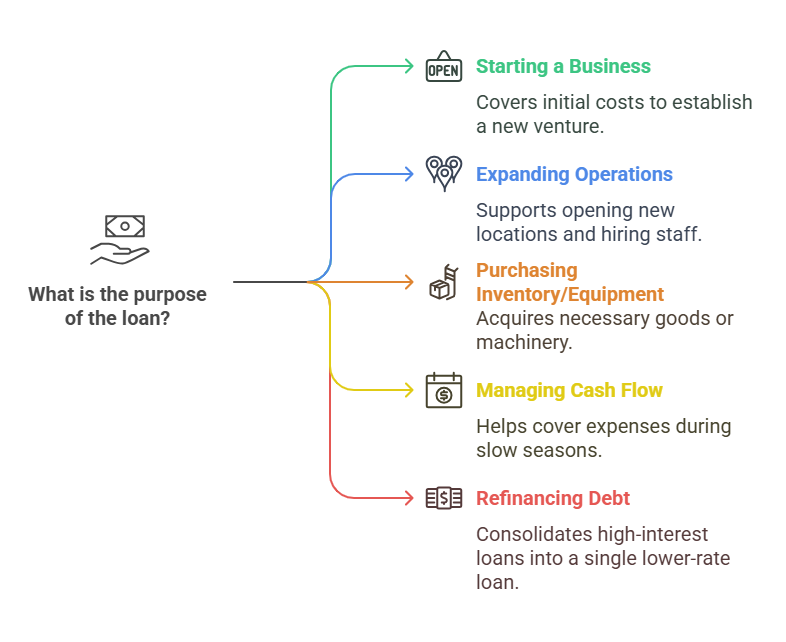

4. Why Do Businesses Need Loans?

Common reasons include:

- Starting a business (covering initial costs).

- Expanding operations (opening new locations, hiring staff).

- Purchasing inventory or equipment.

- Managing cash flow (covering slow seasons).

- Refinancing debt (consolidating high-interest loans).

5. Eligibility Criteria for Business Loans

Lenders look at:

✔ Credit Score (personal & business).

✔ Business Revenue & Profitability.

✔ Time in Business (startups may struggle).

✔ Collateral (for secured loans).

✔ Debt-to-Income Ratio (DTI).

6. How to Apply for a Business Loan

Step 1: Check Your Credit Score

- Personal credit (FICO 650+ is ideal).

- Business credit (Dun & Bradstreet report).

Step 2: Gather Documents

- Bank statements

- Tax returns

- Business plan

- Financial projections

Step 3: Compare Lenders

- Banks (strict but low rates).

- Online lenders (faster but higher rates).

- Credit unions (member-focused).

Step 4: Submit Your Application

- Fill out forms accurately.

- Be ready for follow-up questions.

Step 5: Review Loan Terms Before Signing

- Check interest rates, fees, and repayment terms.

7. Tips to Improve Loan Approval Chances

✅ Boost Your Credit Score (pay bills on time, reduce debt).

✅ Increase Revenue (show steady cash flow).

✅ Prepare a Solid Business Plan (lenders want to see viability).

✅ Offer Collateral (lowers risk for lenders).

✅ Reduce Existing Debt (improves DTI ratio).

8. Pros and Cons of Business Loans

Pros:

✔ Access to capital for growth.

✔ Retain full business ownership (unlike investors).

✔ Potential tax deductions on interest.

Cons:

❌ Debt must be repaid (even if business struggles).

❌ Interest adds to costs.

❌ Collateral may be required.

9. Alternatives to Business Loans

If a loan isn’t the right fit, consider:

- Business credit cards (for short-term expenses).

- Investors or venture capital (for high-growth startups).

- Crowdfunding (for product-based businesses).

- Grants (free money, but competitive).

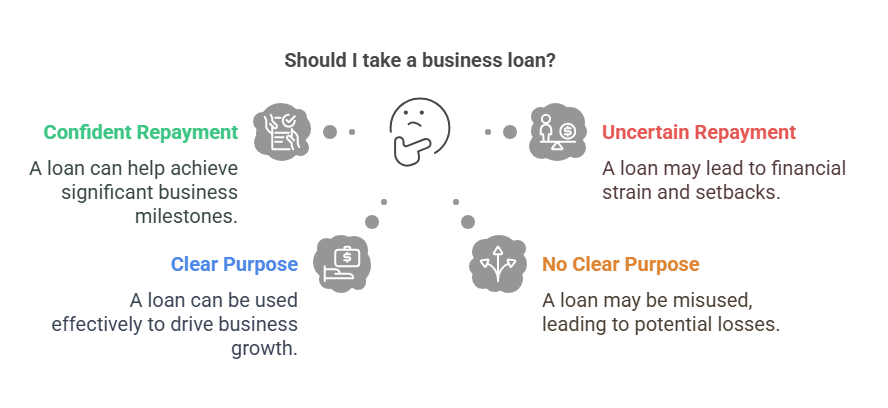

10. Final Thoughts: Is a Business Loan Right for You?

A business loan can be a powerful tool—if used wisely. Before borrowing:

- Assess your needs (how much do you really need?).

- Compare lenders (don’t settle for the first offer).

- Plan repayment (avoid overborrowing).

If you’re confident in your ability to repay and have a clear purpose for the funds, a business loan could be the key to unlocking your company’s next big milestone.

Need Help Choosing a Loan?

Consult a financial advisor or use online loan comparison tools to find the best fit for your business.

Remember: Smart borrowing today leads to a stronger business tomorrow.

Frequently Asked Questions (FAQs) About Business Loans

1. General Business Loan FAQs

Q1: What is a business loan, and how does it work?

A business loan is a financing option where a lender provides capital to a business, which must be repaid with interest over time.

- How it works:

- You apply with a bank, credit union, or online lender.

- The lender reviews your credit, revenue, and business history.

- If approved, you receive funds in a lump sum or as a credit line.

- You repay in installments (monthly, weekly, or daily).

Q2: What can I use a business loan for?

Common uses include:

✔ Starting a business

✔ Expanding operations (new locations, hiring)

✔ Buying inventory or equipment

✔ Covering cash flow gaps

✔ Refinancing existing debt

Q3: What’s the difference between a secured and unsecured business loan?

- Secured Loan: Requires collateral (e.g., property, equipment). Lower interest rates but higher risk (lender can seize assets if you default).

- Unsecured Loan: No collateral needed. Higher interest rates, stricter credit requirements.

Q4: How much can I borrow with a business loan?

- 5,000–5,000–500,000 (online lenders)

- Up to $5 million+ (banks & SBA loans)

Factors affecting loan size:

- Business revenue

- Credit score

- Loan purpose

2. Eligibility & Approval FAQs

Q5: What credit score do I need for a business loan?

- Minimum FICO Score:

- Banks: 680+

- Online Lenders: 600+

- Startups/SBA Loans: 650+ (personal credit matters if business is new)

Q6: How long should my business be operating to qualify?

- Traditional Banks: 2+ years

- Online Lenders: 6 months – 1 year

- Startup Loans: Possible with strong personal credit & business plan

Q7: What documents do I need to apply?

Common requirements:

- Business Plan (for startups)

- Bank Statements (3–6 months)

- Tax Returns (business & personal)

- Profit & Loss Statements

- Legal Documents (licenses, EIN, leases)

Q8: Why was my business loan denied?

Top reasons for rejection:

- Low credit score

- Insufficient revenue

- Short time in business

- Too much existing debt

- Weak cash flow

How to fix it: Improve credit, increase revenue, or seek alternative lenders.

3. Interest Rates & Fees FAQs

Q9: What’s a good interest rate for a business loan?

Rates depend on loan type & lender:

- Bank Loans: 4% – 10% APR

- SBA Loans: 6% – 13% APR

- Online Lenders: 7% – 30% APR

- Merchant Cash Advances: 20% – 250% APR (expensive!)

Tip: Compare APRs (includes fees), not just interest rates.

Q10: What fees come with a business loan?

Watch out for:

- Origination Fees (1% – 6% of loan amount)

- Prepayment Penalties (for paying off early)

- Late Payment Fees

- Underwriting Fees

Always read the fine print!

4. Repayment & Loan Terms FAQs

Q11: How long do I have to repay a business loan?

Loan terms vary:

- Short-Term Loans: 3 months – 3 years

- Medium-Term Loans: 3–5 years

- Long-Term Loans: 5–25 years (SBA, commercial mortgages)

Q12: What happens if I can’t repay my business loan?

Possible consequences:

- Late fees & higher interest

- Damage to credit score

- Collateral seizure (if secured loan)

- Legal action (if personal guarantee signed)

Solutions:

- Negotiate a payment plan

- Refinance the debt

- Seek credit counseling

Q13: Can I pay off my business loan early?

- Yes, but check for prepayment penalties (some lenders charge fees).

- SBA loans usually allow early repayment without penalties.

5. Alternative Funding FAQs

Q14: What if I don’t qualify for a traditional business loan?

Consider:

- Business Credit Cards (0% APR introductory offers)

- Invoice Financing (borrow against unpaid invoices)

- Crowdfunding (Kickstarter, GoFundMe)

- Grants (Small Business Grants, local programs)

Q15: Is a merchant cash advance (MCA) a good alternative?

Pros:

- Fast funding (24–48 hours)

- No collateral needed

Cons:

- Extremely high fees (factor rates = 1.2–1.5)

- Daily repayments hurt cash flow

Best for: Emergency funding (but avoid if possible).

6. SBA Loan FAQs

Q16: What is an SBA loan, and how does it work?

- Government-backed loans with lower rates & longer terms.

- Types:

- SBA 7(a): General business use (up to $5M).

- SBA 504: Real estate & equipment (up to $5.5M).

- Microloans: Up to $50K for startups.

Q17: How hard is it to get an SBA loan?

Approval challenges:

- Strict eligibility (good credit, strong business plan).

- Slow processing (30–90 days).

Tip: Work with an SBA-preferred lender for faster approval.

7. Final Advice & Next Steps

Q18: How do I choose the best business loan?

Ask yourself:

- How much do I need?

- How quickly do I need funds?

- Can I afford the monthly payments?

- What’s the total cost (APR + fees)?

Compare at least 3 lenders before deciding.

Q19: Where should I apply for a business loan?

- Banks (Chase, Bank of America) – Best for established businesses.

- Credit Unions – Lower rates for members.

- Online Lenders (Fundbox, Kabbage) – Faster approvals, higher rates.

- SBA Lenders – Best for long-term, low-cost financing.

Q20: What’s the #1 mistake to avoid with business loans?

Borrowing more than you can repay.

- Calculate cash flow to ensure you can handle payments.

- Avoid stacking multiple high-interest loans.

Conclusion

Business loans can be powerful tools—if used wisely. By understanding the eligibility requirements, interest rates, and repayment terms, you can secure financing that helps your business grow without unnecessary risk.

Next Steps:

- Check your credit score (Experian, Credit Karma).

- Gather financial documents (tax returns, bank statements).

- Compare lenders (NerdWallet, Lendio).

Still unsure? Consult a financial advisor for personalized guidance.