In today’s fast-paced world, the dream of homeownership can often feel overwhelming. Navigating complex financial terms, understanding mortgage options, and managing paperwork can seem daunting. Enter Rocket Mortgage, a revolutionary approach to home financing that combines cutting-edge technology with a human touch, making the journey to homeownership smoother, faster, and more personalized.

What is Rocket Mortgage?

Rocket Mortgage, developed by Quicken Loans, is an online mortgage platform that has redefined how people apply for and secure home loans. Unlike traditional mortgage processes, which often involve lengthy paperwork, in-person meetings, and weeks of waiting, Rocket Mortgage streamlines the entire experience. It allows users to complete the entire mortgage application process online, from the comfort of their home, while still providing access to real, human experts when needed.

The Human Side of Rocket Mortgage

While technology is at the core of Rocket Mortgage, what truly sets it apart is its commitment to humanizing the mortgage process. Here’s how Rocket Mortgage puts people first:

- Personalized Guidance: Rocket Mortgage isn’t just about algorithms and automated systems. It connects users with licensed mortgage experts who are available to answer questions, provide advice, and guide applicants every step of the way. Whether you’re a first-time homebuyer or a seasoned investor, these experts ensure you feel supported and informed.

- Transparency and Trust: The platform is designed to demystify the mortgage process. It provides clear, easy-to-understand explanations of terms, rates, and options, empowering users to make confident decisions. This transparency builds trust, a crucial element in something as significant as financing a home.

- Flexibility and Convenience: Rocket Mortgage understands that life doesn’t stop for a mortgage application. That’s why it offers 24/7 access to its platform, allowing users to work on their application whenever it’s convenient for them. Whether it’s late at night or during a lunch break, Rocket Mortgage adapts to your schedule.

- Empathy in Design: The platform is built with the user in mind. Its intuitive interface and step-by-step process ensure that even those unfamiliar with mortgages can navigate it with ease. If you ever feel stuck, a quick call or chat with a mortgage expert can provide the reassurance you need.

How Rocket Mortgage Works

The process of securing a mortgage through Rocket Mortgage is straightforward and user-friendly:

- Get Started Online: Users begin by answering a few simple questions about their financial situation and homebuying goals. The platform uses this information to generate personalized mortgage options.

- Upload Documents Securely: Rocket Mortgage’s secure document upload feature allows users to submit necessary paperwork digitally, eliminating the need for physical copies or in-person visits.

- Real-Time Approval: One of the standout features of Rocket Mortgage is its ability to provide real-time approval decisions. This means users can get a clear idea of their eligibility and loan options almost instantly.

- Connect with Experts: Throughout the process, users can connect with mortgage experts who can clarify doubts, offer advice, and help tailor the loan to their specific needs.

- Close with Confidence: Once approved, Rocket Mortgage guides users through the final steps, ensuring a smooth and stress-free closing process.

Why Choose Rocket Mortgage?

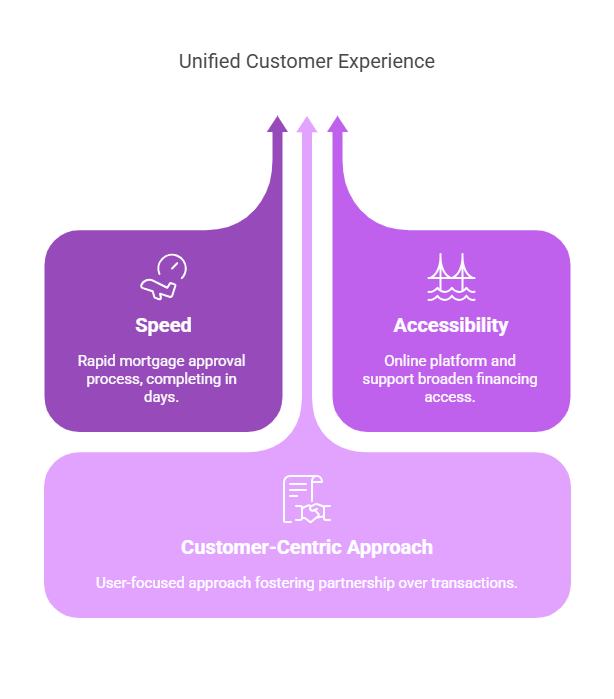

Rocket Mortgage has earned its reputation as a leader in the mortgage industry by combining innovation with empathy.

- Speed: The platform’s efficiency reduces the time it takes to secure a mortgage, often completing the process in just days rather than weeks.

- Accessibility: With its online platform and human support, Rocket Mortgage makes home financing accessible to a wider audience, including those who may feel intimidated by traditional methods.

- Customer-Centric Approach: Rocket Mortgage prioritizes the needs and experiences of its users, ensuring that the process feels less like a transaction and more like a partnership.

Conclusion

Rocket Mortgage is more than just a mortgage lender; it’s a partner in the journey to homeownership. By blending advanced technology with a human touch, it has transformed a traditionally stressful process into one that is approachable, transparent, and empowering. Whether you’re buying your first home or refinancing an existing mortgage, Rocket Mortgage is here to make the experience as smooth and human as possible. After all, a home is more than just a house—it’s where life happens, and Rocket Mortgage understands that better than anyone.

Frequently Asked Questions (FAQs) About Rocket Mortgage

Rocket Mortgage has revolutionized the home financing process, but it’s natural to have questions about how it works and whether it’s the right choice for you. Below are some of the most common questions and answers to help you better understand Rocket Mortgage.

1. What is Rocket Mortgage?

Rocket Mortgage is an online mortgage platform developed by Quicken Loans. It allows users to apply for and manage their mortgages entirely online, offering a fast, convenient, and transparent experience. The platform combines advanced technology with access to human mortgage experts for personalized support.

2. How does Rocket Mortgage work?

Rocket Mortgage simplifies the mortgage process into a few easy steps:

- Answer a few questions about your financial situation and homebuying goals.

- Upload necessary documents securely online.

- Receive real-time approval decisions.

- Connect with a mortgage expert for guidance and customization.

- Close on your loan with confidence.

3. Is Rocket Mortgage safe to use?

Yes, Rocket Mortgage is safe and secure. Additionally, Quicken Loans, the parent company of Rocket Mortgage, is one of the largest and most trusted mortgage lenders in the U.S.

4. Can I get a mortgage without speaking to a human?

While Rocket Mortgage is designed to be fully online, you always have the option to speak with a licensed mortgage expert if you have questions or need assistance. The platform combines the convenience of technology with the reassurance of human support.

5. How fast is the approval process?

One of Rocket Mortgage’s standout features is its speed. Many users receive real-time approval decisions within minutes of completing their application. The entire process, from application to closing, can often be completed in just a few days.

6. What types of loans does Rocket Mortgage offer?

- Conventional loans

- FHA loans

- VA loans

- Jumbo loans

- Refinancing options

- Fixed-rate and adjustable-rate mortgages (ARMs)

7. Can I use Rocket Mortgage if I’m a first-time homebuyer?

Absolutely! Rocket Mortgage is an excellent option for first-time homebuyers. The platform’s user-friendly interface and access to mortgage experts make it easy to understand the process and find a loan that fits your needs.

8. What documents do I need to apply?

To apply for a mortgage through Rocket Mortgage, you’ll typically need:

- Proof of assets

- Identification (driver’s license, passport)

- Information about your debts and expenses

9. Can I refinance my existing mortgage with Rocket Mortgage?

Yes, Rocket Mortgage offers refinancing options. Whether you’re looking to lower your interest rate, reduce your monthly payments, or tap into your home’s equity, Rocket Mortgage can help you explore your refinancing options.

10. How does Rocket Mortgage compare to traditional lenders?

Rocket Mortgage offers several advantages over traditional lenders

- Speed: Real-time approvals and faster processing times.

- Transparency: Clear explanations of terms, rates, and fees.

- Support: Access to human experts whenever you need help.

11. Are there any fees to use Rocket Mortgage?

Rocket Mortgage does not charge upfront fees to use its platform. However, like any mortgage, there may be closing costs and fees associated with your loan. These will be clearly outlined during the application process.

12. Can I use Rocket Mortgage if I have less-than-perfect credit?

Yes, Rocket Mortgage works with borrowers across a range of credit scores. While a higher credit score may qualify you for better rates, the platform can help you explore loan options even if your credit isn’t perfect.

13. How do I contact Rocket Mortgage if I have questions?

You can contact Rocket Mortgage’s customer support team 24/7 via phone, email, or live chat. Their licensed mortgage experts are always available to assist you.

14. Is Rocket Mortgage available in all states?

Yes, Rocket Mortgage is available in all 50 U.S. states and Washington, D.C. However, specific loan options and terms may vary depending on your location.

15. What makes Rocket Mortgage different from other online lenders?

Rocket Mortgage stands out for its combination of technology and human support. While many online lenders focus solely on automation, Rocket Mortgage ensures you have access to real experts who can provide personalized guidance and answer your questions.