Running a small business is no small feat. As a business owner, you wear many hats—entrepreneur, marketer, customer service representative, and often, the accountant. Among the many responsibilities you juggle, managing payroll can be one of the most time-consuming and complex tasks. But what if there was a way to simplify payroll, save time, and ensure accuracy? Enter streamlined payroll solutions—a game-changer for small businesses looking to focus on growth rather than getting bogged down by administrative tasks.

In this article, we’ll explore what streamlined payroll solutions are, why they matter for small businesses, and how they can transform the way you manage your finances. We’ll also dive into the key features to look for in a payroll service, the benefits of outsourcing payroll, and tips for choosing the right solution for your business. By the end, you’ll have a clear understanding of how to take the stress out of payroll and free up your time to focus on what really matters—growing your business.

What Are Streamlined Payroll Solutions?

Streamlined payroll solutions are tools, software, or services designed to simplify and automate the payroll process. These solutions handle everything from calculating employee wages and taxes to generating pay stubs and filing tax forms. The goal is to make payroll management as efficient and error-free as possible, so you can spend less time on paperwork and more time on your business.

For small businesses, streamlined payroll solutions often come in the form of cloud-based software or outsourced payroll services. These options are tailored to meet the unique needs of small businesses, offering affordability, scalability, and ease of use.

Why Payroll Matters for Small Businesses

Payroll is more than just paying your employees—it’s a critical function that impacts your business’s compliance, cash flow, and employee satisfaction. Here’s why getting payroll right is so important:

- Compliance with Laws and Regulations: Payroll involves adhering to federal, state, and local tax laws, labor regulations, and reporting requirements. Mistakes can lead to penalties, audits, and legal issues.

- Employee Satisfaction: Timely and accurate paychecks are essential for keeping your team happy and motivated. Errors or delays in payroll can damage employee trust and morale.

- Financial Management: Payroll is one of the largest expenses for most businesses. Proper payroll management helps you maintain accurate financial records and make informed decisions about your business’s finances.

- Time Savings: Manual payroll processing is time-consuming and prone to errors. Streamlined solutions automate repetitive tasks, freeing up your time to focus on strategic activities.

Key Features of Streamlined Payroll Solutions

When evaluating payroll solutions for your small business, look for these essential features:

- Automated Payroll Processing: The software should automatically calculate wages, taxes, and deductions based on employee hours and pay rates.

- Tax Compliance: A good payroll solution will handle tax calculations, generate tax forms, and ensure timely filing and payments to tax authorities.

- Direct Deposit: Offering direct deposit is a convenient and efficient way to pay your employees, eliminating the need for paper checks.

- Employee Self-Service Portal: An online portal where employees can access their pay stubs, tax forms, and update personal information reduces administrative workload.

- Integration with Other Systems: Look for payroll software that integrates with your accounting, time-tracking, and HR systems for seamless data flow.

- Scalability: As your business grows, your payroll solution should be able to scale with you, accommodating more employees and additional features.

- Customer Support: Reliable customer support is crucial for resolving issues quickly and ensuring smooth payroll operations.

The Benefits of Outsourcing Payroll

For many small businesses, outsourcing payroll to a specialized service provider is the ultimate form of streamlining. Key benefits:

- Expertise and Accuracy: Payroll providers are experts in their field, ensuring that your payroll is processed accurately and in compliance with all regulations.

- Time Savings: Outsourcing payroll frees up your time to focus on core business activities, such as sales, marketing, and customer service.

- Cost-Effectiveness: While there is a cost associated with outsourcing, it can be more affordable than hiring an in-house payroll specialist or dealing with the consequences of payroll errors.

- Access to Advanced Technology: Payroll providers use cutting-edge software that offers features and capabilities you might not be able to afford on your own.

- Reduced Risk: By outsourcing, you transfer the responsibility for compliance and accuracy to the provider, reducing your risk of penalties and legal issues.

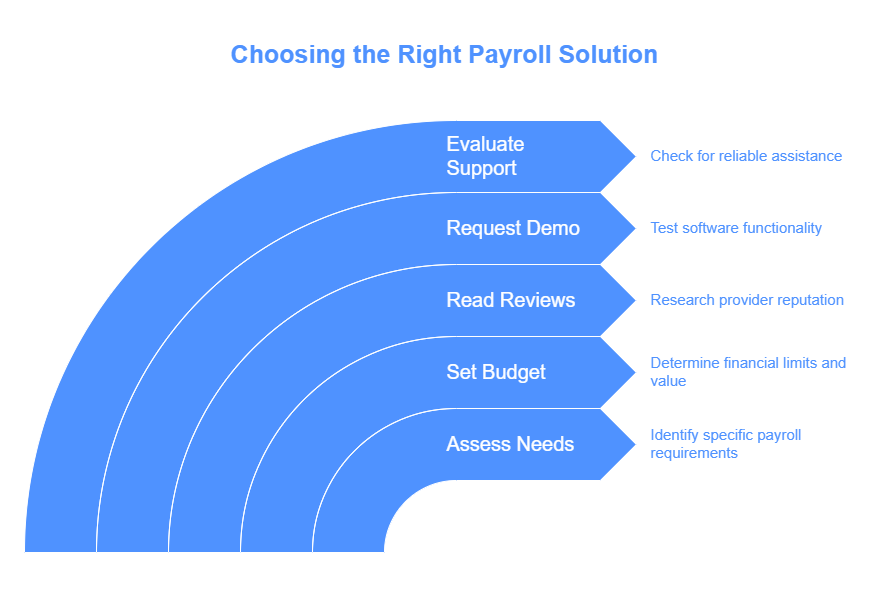

How to Select the Right Payroll Solution for Your Business

With so many payroll solutions available, choosing the right one for your small business can feel overwhelming. This is the some tips to help you make the best decision:

- Assess Your Needs: Start by identifying your business’s specific payroll needs. How many employees do you have? Do you need tax filing services? Are you looking for additional HR features?

- Set a Budget: Determine how much you’re willing to spend on payroll services. Keep in mind that the cheapest option may not always be the best—consider the value and features you’re getting for the price.

- Read Reviews and Ask for Recommendations: Research different payroll providers online and read reviews from other small business owners.

- Request a Demo: Many payroll providers offer free demos or trials. Take advantage of these to test the software and see if it meets your needs.

- Evaluate Customer Support: Make sure the provider offers reliable customer support, including phone, email, and chat options. You’ll want to know that help is available when you need it.

- Check for Scalability: Choose a solution that can grow with your business. You don’t want to outgrow your payroll system and have to switch providers down the line.

- Consider Integration: If you’re already using accounting or HR software, look for a payroll solution that integrates seamlessly with your existing systems.

Real-Life Examples of Streamlined Payroll in Action

To illustrate the impact of streamlined payroll solutions, let’s look at a couple of real-life examples:

Example 1: A Small Retail Business

Sarah owns a small boutique with five employees. She used to spend hours every week manually calculating wages, taxes, and deductions. After switching to a cloud-based payroll solution, Sarah was able to automate the entire process. The software calculates everything for her, generates pay stubs, and even files her taxes. Sarah now has more time to focus on growing her business and serving her customers.

Example 2: A Growing Tech Startup

John runs a tech startup with 20 employees. As his business grew, he found it increasingly difficult to manage payroll in-house. He decided to outsource payroll to a specialized provider. The provider handles all aspects of payroll, from processing payments to ensuring tax compliance. John no longer has to worry about payroll errors or staying up-to-date with changing regulations. He can now focus on developing new products and expanding his business.

Tips for a Smooth Transition to Streamlined Payroll

If you’re ready to make the switch to a streamlined payroll solution, here are some tips to ensure a smooth transition:

- Gather Your Data: Before implementing a new payroll system, gather all necessary employee and payroll data, including names, addresses, Social Security numbers, pay rates, and tax information.

- Train Your Team: Make sure your team is familiar with the new system. Provide training and resources to help them navigate the software or self-service portal.

- Communicate with Employees: Let your employees know about the change and explain how it will benefit them. Address any concerns they may have and provide clear instructions for accessing their pay stubs and tax forms.

- Test the System: Before going live, run a test payroll to ensure everything is working correctly. This will help you identify and resolve any issues before they affect your employees.

- Monitor and Adjust: After implementing the new system, monitor its performance and make adjustments as needed. Stay in touch with your payroll provider to address any questions or concerns.

The Future of Payroll for Small Businesses

As technology continues to evolve, so too will payroll solutions for small businesses. Here are some trends to watch for in the coming years:

- Artificial Intelligence (AI): AI-powered payroll systems will become more common, offering advanced features like predictive analytics and automated error detection.

- Mobile Accessibility: Payroll solutions will increasingly offer mobile apps, allowing business owners and employees to manage payroll on the go.

- Enhanced Security: With the rise of cyber threats, payroll providers will invest in advanced security measures to protect sensitive employee data.

- Global Payroll Solutions: As more businesses operate internationally, payroll providers will offer solutions that handle multi-country payroll and compliance.

- Integration with HR and Benefits: Payroll systems will become more integrated with HR and benefits platforms, offering a seamless experience for managing all aspects of employee compensation.

Conclusion: Simplify Payroll, Empower Your Business

Streamlined payroll solutions are more than just a convenience—they’re a necessity for small businesses looking to thrive in today’s competitive landscape. By automating and simplifying payroll, you can save time, reduce errors, and ensure compliance with laws and regulations. Whether you choose to invest in payroll software or outsource to a provider, the right solution can transform the way you manage your finances and free you up to focus on what really matters—growing your business.

So, take the first step today. Evaluate your payroll needs, explore your options, and make the switch to a streamlined payroll solution. Your business—and your sanity—will thank you.

By embracing streamlined payroll solutions, you’re not just simplifying a process—you’re empowering your business to reach new heights. After all, when you’re not bogged down by administrative tasks, you can channel your energy into what you do best: building a successful and thriving small business.

FAQs About Streamlined Payroll Solutions for Small Businesses

Switching to a streamlined payroll solution can feel like a big step, especially if you’re used to handling payroll manually or with outdated systems. To help you navigate this transition, we’ve compiled a list of frequently asked questions (FAQs) about streamlined payroll solutions. Whether you’re curious about costs, features, or how to get started, these answers will guide you in making the best decision for your small business.

1. What is a streamlined payroll solution?

A streamlined payroll solution is a tool, software, or service designed to simplify and automate the payroll process. It handles tasks like calculating wages, deducting taxes, generating pay stubs, and filing tax forms. The goal is to save time, reduce errors, and ensure compliance with labor and tax laws.

2. Why should small businesses use streamlined payroll solutions?

Small businesses often lack the resources to manage payroll manually or hire a dedicated payroll specialist. Streamlined payroll solutions offer several benefits:

- Time savings: Automates repetitive tasks.

- Accuracy: Reduces the risk of errors in calculations and tax filings.

- Compliance: Keeps your business up-to-date with tax laws and regulations.

- Cost-effectiveness: Often more affordable than hiring an in-house payroll expert.

- Employee satisfaction: Ensures timely and accurate paychecks.

3. How much does a payroll solution cost for small businesses?

The cost of payroll solutions varies depending on the provider, features, and the size of your business. Most providers charge a base fee (e.g., 20–20–50 per month) plus a per-employee fee (e.g., 2–2–10 per employee). Some providers also offer tiered pricing plans, with more advanced features available at higher price points.

4. Can I handle payroll on my own without a solution?

While it’s possible to handle payroll manually or using spreadsheets, it’s not recommended for small businesses. Manual payroll is time-consuming, prone to errors, and increases the risk of non-compliance with tax laws. A streamlined payroll solution automates these tasks, saving you time and reducing stress.

5. What features should I look for in a payroll solution?

When choosing a payroll solution, look for these key features:

- Automated payroll processing

- Tax calculation and filing

- Direct deposit

- Employee self-service portals

- Integration with accounting and HR software

- Scalability to grow with your business

- Reliable customer support

6. Is outsourcing payroll better than using software?

It depends on your business’s needs and preferences:

- Outsourcing: Ideal if you want to completely hand off payroll to experts. It’s more hands-off but may cost more.

- Payroll Software: Great if you want to maintain control over payroll while still automating tasks. It’s often more affordable and customizable.

7. How do I know if a payroll solution is right for my business?

Consider the following:

- Does it meet your business’s specific needs (e.g., number of employees, tax filing requirements)?

- Is it within your budget?

- Does it integrate with your existing systems (e.g., accounting software)?

- Is it easy to use for you and your employees?

- Does the provider offer good customer support?

8. What are the risks of not using a payroll solution?

Without a streamlined payroll solution, you risk:

- Errors: Mistakes in calculations or tax filings can lead to penalties.

- Non-compliance: Failing to adhere to labor and tax laws can result in fines or legal issues.

- Time drain: Manual payroll takes time away from growing your business.

- Employee dissatisfaction: Late or incorrect paychecks can harm morale.

9. Can payroll solutions handle tax filings?

Yes, most modern payroll solutions handle tax calculations, generate tax forms (e.g., W-2s and 1099s), and ensure timely filing and payments to tax authorities. This feature is a major time-saver and helps you stay compliant.

10. What if I have employees in multiple states?

Many payroll solutions are equipped to handle multi-state payroll. They can calculate state-specific taxes, comply with local labor laws, and file the necessary forms for each state. Be sure to choose a provider that offers this capability if you have employees in different states.

11. How long does it take to set up a payroll solution?

The setup time varies depending on the provider and the complexity of your payroll. Most cloud-based payroll solutions can be set up in a few hours or days. You’ll need to input employee information, tax details, and bank account information to get started.

12. Can I switch payroll providers if I’m not satisfied?

Yes, you can switch payroll providers if your current solution isn’t meeting your needs. However, the process can be time-consuming, so it’s important to choose the right provider from the start. Look for providers that offer data migration assistance to make the transition smoother.

13. Are payroll solutions secure?

Reputable payroll solutions use advanced security measures, such as encryption, multi-factor authentication, and regular security audits, to protect your data. Always choose a provider with a strong track record of data security.

14. What happens if I make a mistake in payroll?

If you make a mistake, most payroll solutions allow you to correct it easily. For example, you can issue an adjustment paycheck or update tax filings. If you’re using an outsourced service, the provider will typically handle corrections for you.

15. Can payroll solutions help with year-end reporting?

Yes, payroll solutions simplify year-end reporting by automatically generating and filing required forms, such as W-2s for employees and 1099s for contractors. This ensures compliance and saves you time during the busy tax season.

16. Do payroll solutions work for freelancers or contractors?

Yes, many payroll solutions are designed to handle payments for freelancers and contractors. They can generate 1099 forms and ensure compliance with tax regulations for non-employee workers.

17. What if I only have a few employees? Are payroll solutions still worth it?

Absolutely! Even if you have just a few employees, payroll solutions can save you time and reduce the risk of errors. Many providers offer affordable plans tailored to very small businesses.

18. Can I try a payroll solution before committing?

Most payroll providers offer free trials or demos, allowing you to test the software before making a commitment. Take advantage of these offers to ensure the solution meets your needs.

19. How do I train my employees to use a new payroll system?

Many payroll solutions come with employee self-service portals that are intuitive and easy to use. Provide a brief training session or share instructional resources (e.g., videos or guides) to help your team get started.

20. What’s the difference between payroll software and an outsourced payroll service?

- Payroll Software: You manage payroll yourself using the software. It’s more hands-on but offers greater control and customization.

- Outsourced Payroll Service: A third-party provider handles all aspects of payroll for you. It’s more hands-off but may cost more.

21. Can payroll solutions integrate with other business tools?

Yes, many payroll solutions integrate with accounting software (e.g., QuickBooks), time-tracking tools, and HR systems. This ensures seamless data flow and reduces the need for manual data entry.

22. What if I need help with my payroll solution?

Most payroll providers offer customer support via phone, email, or chat. Look for a provider with a reputation for responsive and helpful support.

23. Are there free payroll solutions for small businesses?

While there are some free or low-cost payroll tools available, they often have limited features. For most small businesses, investing in a paid solution is worth it for the added functionality and peace of mind.

24. How do I choose between cloud-based and desktop payroll software?

- Cloud-Based: Accessible from anywhere, automatic updates, and scalable. Ideal for businesses that want flexibility and remote access.

- Desktop: Installed on your computer, one-time purchase, and no ongoing subscription fees. Suitable for businesses with limited internet access or those who prefer offline tools.

25. What’s the best payroll solution for my small business?

The best payroll solution depends on your business’s unique needs, budget, and preferences. Start by assessing your requirements, researching providers, and testing a few options to find the right fit.

Final Thoughts

Streamlined payroll solutions are a powerful tool for small businesses looking to save time, reduce errors, and stay compliant. By understanding your options and asking the right questions, you can find a solution that works for your business and helps you focus on what really matters—growth and success. If you’re still unsure, reach out to payroll providers for demos or consultations to get a feel for what they offer. Your business deserves a payroll system that’s as efficient and forward-thinking as you are!